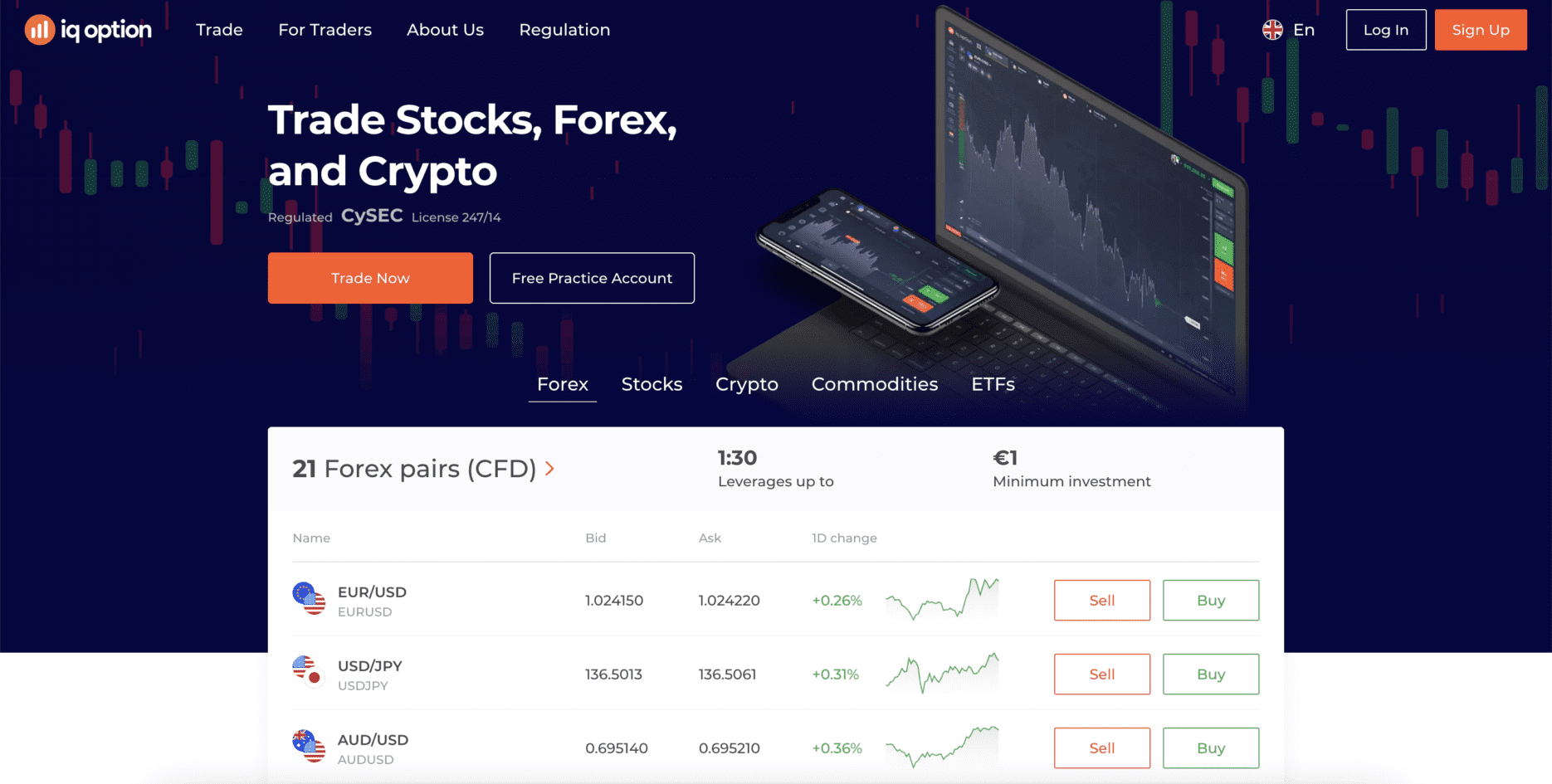

IQ Option is a broker, offering to trade with CFDs on forex, cryptocurrencies and stocks. Learn more about CFDs here. The company is licensed in Europe by the Cypriot financial authority CySEC. The broker is known for its unique trading platform and minimalistic requirements for creating a live account (min. deposit is 10$ and min. trade investment is 1$.)

IQ Option Review – Broker overview

| Minimum deposit | 10 USD |

| Platform | their own |

| Regulated broker | Yes |

| Regulations | CySEC |

| Demo account | Yes |

Special features and advantages

| Trailing Stop-Loss | Price alerts | Many education opportunities |

Trading platform

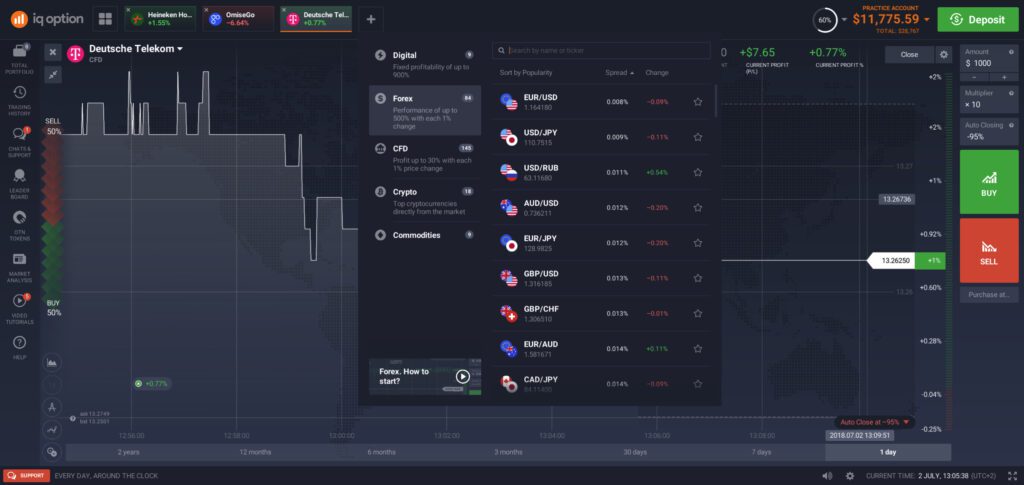

IQ Option uses its own trading platform unlike most of its competitors. It has a very nice modern feel and works promptly, I have not experienced any major response when trading so far. The company offers CFDs on currency pairs (forex), cryptocurrencies, stocks, commodities and ETFs. In addition to these classic financial instruments, there is one that is only available at IQ Option, the so-called forex options. Professional traders also have access to binary and digital options.

IQ Option – Accounts

IQ Option provides 2 types of accounts, the first is a free demo account. Traders can use this unlimitedly according to their needs, no deposit is required to open it. In the practice account, each trader has $10,000 with which he can trade freely. In case of having traded them already, simply click on a button to refill the imaginary funds.

The real account can be funded from $10, and you need at least $1 to make one trade. These extremely low micro transactions allow anyone to trade. By getting a real account, you also have the ability to chat with other traders on the platform and you also have access to an extensive tutorial center thanks to it.

IQ Option – Account verification

IQ Option is a regulated company that must verify the identity of every trader with a live account. Previously it was only possible to have your identity verified when withdrawing funds. However, the regulatory authorities (e.g. FCA, CySEC) have set a new rule that clients must verify their identity at the time of deposit. In the past, some traders complained to regulated companies that they would not allow them to withdraw money (but they could not process withdrawals because people did not have their identity verified).

The good news about the verification process is that you only have to go through it once. Then all your deposits and withdrawals are processed almost immediately. Every regulated broker, including IQ Option, has to verify your identity and where you live. To do this, you always need one of the following documents:

- Identity verification – ID/driver’s license, passport

- Verification of residence – Bank statement, bills for housing, electricity, gas, water

The document verifying your residence cannot be more than 6 months old. The details of your name and address must be legibly visible. If you have internet banking, for example, you can also use an electronic statement. If you have chosen to fund your account using a credit or debit card, you must provide a copy of both sides of the card used. For your own security, you can hide the CCV number (the 3 digits located on the back of the card). IQ Option needs to verify your card so that only the first 6 and last 4 digits of your card are visible.

The IQ Option team has to individually verify all the documents you send, so the process normally takes 3 trading days.

Trading hours

Most underlying assets cannot be traded 24/7 so it is important to find out the trading hours for the assets you wish to trade. This information can be found here. Trading hours are listed in the UTC+1 time zone.

IQ Option fees (spreads)

Every trader who trades with IQ Option broker should know what fees they may encounter. IQ Option does not charge so-called commissions for trade creation like some other CFD brokers. Instead, you will encounter a so-called spread and sometimes a nightly fee on the platform. In very rare cases, you may also encounter a withdrawal fee or an inactivity fee. We will now talk a little more about each of IQ Option’s fees and illustrate how large these fees can be.

Spreads

The spread fee is the difference between the price at which you buy an asset and the price at which you sell it back. IQ Option spreads are not as tight as with some other brokers, but they are still very solid. As a general rule, the more popular the asset you trade, the lower the spread. You can find information about the spread on the IQ Option platform in the menu where you select the underlying asset. However, the spread is displayed in percentages, so if you want to know the spread value in pips, you have to head to the left corner when you open the chart of your asset, where you can see the bid and ask price of the asset (see screenshot).

Overnight fee

The second fee that a broker may charge is an overnight fee (swap). This fee is charged if you stay in the trade even though the market is closed. At IQ Option broker, the night fee is usually around 0.003%-0.015%, but can reach up to 0.6%. The swap fee is always charged in the evening, the exact time when it is charged can be found here. Here is also the exact amount of this fee for all assets available on the platform. It is also important to note that the swap fee is tripled for most assets on Fridays (as most markets are closed on the weekend).)

Inactivity fee

If you are inactive on the trading platform for 90 consecutive days, you will be charged an inactivity fee. Said fee equals €50. Please note that this fee is charged every month once a trader’s account is classified as inactive. If there is not enough balance in the trading account to pay this fee, the fee is not charged, as your account can never go into the negative. However, if your account remains inactive for 12 months, it is then automatically closed.

So if you ever plan to stop trading with IQ Option, I would recommend that you withdraw your remaining funds. It is quite easy to avoid the fee this way. In addition, most types of withdrawals are completely free.

Withdrawal fee

The fourth fee you may encounter with a broker in rare cases is the withdrawal fee. However, this fee only applies to bank withdrawals, all other withdrawal methods are free of charge. The amount of this fee is €25.

IQ Option financial leverage

Each asset type on the platform has a different leverage, in the table below you will find a breakdown of the maximum leverage for each asset category. Learn more about financial leverage here. Keep in mind that IQ Option uses the term “multiplier” instead of leverage, however, it functions exactly the same.

| Asset category | Leverage |

| Main forex pairs | 1:30 |

| Minor and exotic forex pairs | 1:20 |

| Shares | 1:5 |

| Cryptocurrencies | 1:2 |

| ETFs | 1:5 |

| Indices | 1:10 for HK50, otherwise 1:20 |

| Commodities | 1:20 for gold, otherwise 1:10 |

IQ Option – Account financing

The following methods can be used to withdraw and deposit funds with the broker: credit and debit cards, Neteller, Skrill, Webmoney, bank transfer and also Paypal.

Personally, I would recommend using electronic wallets because there is no fee for deposits or withdrawals, and deposits are processed instantly. Credit debit cards are also an interesting alternative. Unfortunately, there is a limit that you can only withdraw back to these cards the aggregate amount of deposits that have been made in the last 90 days. Additionally, you must withdraw all the extra money you have earned to your e-wallet or bank account. This restriction is due to the fact that card withdrawals can only be processed in the form of a “chargeback”, which means that the broker can only refund to the card the maximum amount that the investor deposited.

How to deposit

In order to deposit money into your trading account, you must first go through a verification process (described below). Once your account is verified, you can deposit the amount you want. The minimum deposit at IQ Option is set at $10/GBP/EUR. No matter which deposit method you choose, IQ Option does not charge any fees. However, if you choose a bank transfer, make sure you know what fees the bank itself might charge.

How to withdraw

Withdrawing funds is quite simple, after logging into your real account you simply visit the funding section of the account and choose the amount and method of withdrawal. IQ Option has no withdrawal fees, apart from the aforementioned bank transfer. Withdrawals are processed by the broker within 1 business day. Minimum withdrawal amounts are $2.

IQ Option – Review summary

IQ Option offers low minimum deposit and trading via their very own platforms. Although you can find brokers with better spreads, the ones IQ Option charges are not that high. There are some other fees, as described above, such as when withdrawing money using bank transfer.

Advantages

- Low minimum deposit

- No deposit fees

- Relatively strict regulation

- High-quality trading platform of their own

Disadvantages

- Bank transfer withdrawal fee

- Narrow range of assets