Saxo Bank A/S is an investment bank that also operates as a forex broker, which offers CFDs on indices, commodities, options, and exchange-traded warrants in addition to currency pairs. Saxo Bank A/S is licensed in Europe by the Danish regulatory authority FSA. The minimum deposit with the broker is set at $10,000.

Saxo Bank – Broker overview

| Minimum deposit | 10 000 USD |

| Regulated broker | Yes |

| Regulation | FSA |

| Trading platform | Own |

| Demo account | Yes, time-limited |

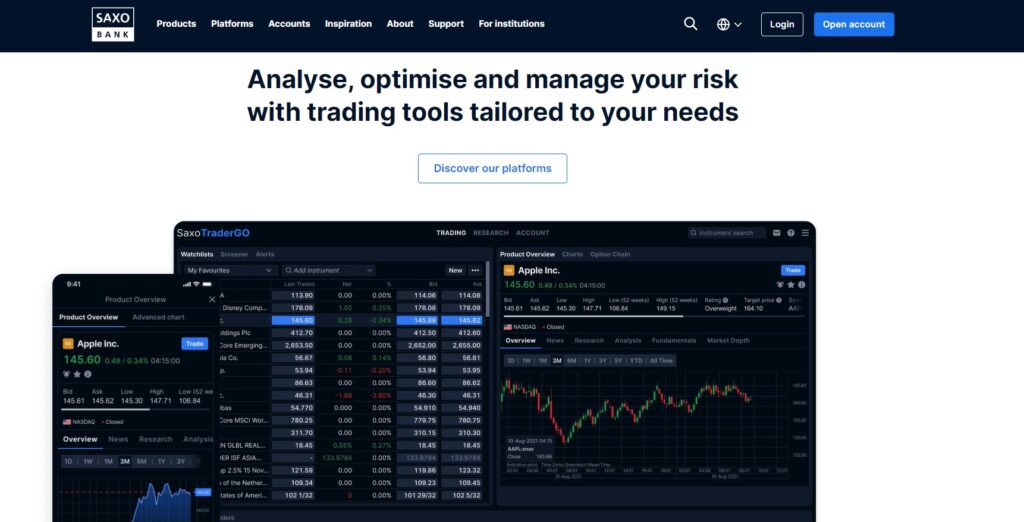

Saxo Bank Trading Platform

Saxo Bank offers two trading platforms for trading: the SaxoTraderPRO and SaxoTraderGO. As the platform names suggest, these are platforms created directly by Saxo Bank broker. Both platforms can be tested on a demo account, which can only be used for 20 days.

Saxo Bank fees (spreads)

Like any other CFD broker, Saxo Bank charges a spread fee. For the current value of this fee, please visit Saxo Bank’s website. We have prepared a small comparison table here, where you can find the amount of Saxo Bank spread fees on popular currency pairs compared to 2 other popular CFD brokers.

| | EUR/USD | USD/JPY | GBP/USD | AUD/USD |

| Saxo Bank | 0.8 | 0.8 | 1.0 | 0.5 |

Advantages and disadvantages summary

Saxo Bank must comply with the strict regulatory guidelines of the FSA. The broker has very decent spreads for new clients, unfortunately we do not know how high the spreads are for existing clients. Supposedly, this information can only be found by existing Saxo Bank clients directly on the trading platform. In addition to CFDs, the company also allows direct purchase of shares and other assets. You can check out more review of RoboMarkets.cz here.

Cons:

- Time-limited demo account

- Not the lowest minimum deposit

Pros:

- FSA

- Regulated and licensed

- Over 800 instruments available

- Own trading platform

- Responsive and reliable in communication

1 Comment

Add Yours →[…] […]