There are a really large number of companies, or brokers if you prefer, on the market nowadays that offer you a large number of trading opportunities. But which one to choose? Which one is the right one for us? This question is certainly asked by a large number of investors. So, let’s now together introduce one very interesting “player” among the brokers on our market. It is the broker DeGiro.

Basic information about DeGiro

DeGiro is operated by its Dutch parent company flatexDEGIRO Bank AG. This company is headquartered in Germany and is regulated by the BaFIN regulatory authority. The Dutch branch is also subject to the Authority for Financial Markets (AFM) and is of course under the strict supervision of the Dutch Central Bank (DNB). In the Czech Republic, the company has been registered under the Czech National Bank since 2013, which allows it to provide its financial services in the country.

| Name of the company | DeGIRO |

| Date and place of creation | 2008 Netherlands |

| What they trade | Stocks, ETFs, bonds, futures, options, leveraged products |

| Account currency | CZK, EUR and many more |

| Payment methods | Bank transfer |

| Minimum deposit | 1 CZK |

| Trading in Czech language | YES |

DeGiro Deposit Insurance

Clients’ funds are kept separate from the broker’s assets so that they are not at risk of the company’s insolvency. Should this situation arise, and clients do not recover their assets, the investor compensation fund will cover the losses. In such a case, the Compensation Fund will pay clients up to 90% of the losses on the unreturned investments (up to a maximum of EUR 20 000 per person).

All cash deposits with flatexDEGIRO Bank AG are insured up to a maximum of EUR 100,000. If you would like more information about insured deposits, you can find it on the official BaFIN (German Audit Office) website.

Broker DeGiro allows its clients to invest in stocks, ETFs, bonds, stock derivatives and other and other financial and investment products. The company can make more than 50 stock exchanges from 30 countries around the world available to its clients. With the app that DeGiro offers, clients can trade stocks from exchanges in America, Europe, as well as stocks from the Prague Stock Exchange. Of course, we will get to detailed information later.

The company is very suitable for smaller investors in particular and this is mainly because they have low trading fees. The fact that there are completely free deposits and withdrawals, the possibility of keeping accounts in Czech crowns and also transparent information may also be important for the clients’ decision-making. And even directly in the Czech language. So even those who are not too fond of foreign languages and foreign financial assets will find something to their liking.

Instruments for trading

Each broker may offer different products. It is a great advantage for clients if brokers offer a large number of products and clients can therefore choose or even change their investments over time. It is also essential to note that each broker targets a different variety of clients. Some focus more on large investors and others are suitable for clients as low as, say, €1. DeGiro does not position itself in either of these positions. It offers its products to everyone, regardless of the amount of money the client wants to invest.

Clients can trade securities, derivatives and leveraged products with this broker. If we talk about how many products the company actually offers, we are talking about tens of thousands of investment product options.

DeGiro instruments:

- Stocks – European and US stocks (NYSE, NASDAQ, Xetra, BCPP…)

- Bonds – bonds traded on European exchanges or over-the-counter

- Leveraged products – leveraged products from Euronext, Xetra and FWB exchanges

- Currencies – access to the US currency exchange Currenex

- ETFs – funds traded on 17 European exchanges (Euronext, Xetra…)

- Futures and Options – US and European exchanges including CME, CBOE, Eurex and Euronext

- Other – Warrants, ETNs, ADRs, exchange/overseas investment funds

Despite the fact that companies offer us a really large number of options, trading of contracts for difference (CFDs) or cryptocurrency trading is not supported by DEGIRO.

Comparison of the offer with competitors:

| DeGIRO | XTB | eToro | BitMarkets | |

| Stocks | YES | YES | YES | – |

| ETF | YES | YES | YES | – |

| Bonds | YES | – | – | – |

| Futures and options | YES | – | – | – |

| Cryptocurrency | – | – | YES | YES |

| CFD | – | YES | YES | – |

| [review] | [review] | [review] | [review] |

Now let’s talk about a specific trade such as stocks, ETFs, or dividends, for example.

Stocks and ETFs

DeGiro is definitely a great fit for clients who are looking for an affordable broker while also looking to trade US or European stocks. The broker supports a really large number of stock exchanges, including the Prague stock exchange BCPP, the German XETRA, the European Euronext exchange or the nowadays very popular American exchanges NASDAQ and NYSE.

Thanks to Degiro, you can find shares in technology companies such as Apple, Google, Microsoft, Tesla and Amazon, for example. It can also trade German car companies, for example, which are very interesting for clients. These include BMW. Now we have talked about classic stocks. But DeGIRO also offers so-called ETF funds from European stock exchanges. With ETFs, you can invest in, for example, stock market indices (S&P 500, DAX, Nasdaq 100) or commodities such as gold or silver.

Dividend payment

What is very interesting for the client and I evaluate very positively is the fact that any dividends are credited directly to the client’s trading account. Of course, everything is credited after deduction of withholding tax. However, what I cannot evaluate positively, and I can see room for improvement is the amount of tax. Dividends from Czech companies are unfortunately taxed at a higher rate. The normal rate is usually 15 %. Well, you have to admit to yourselves that the 20% difference in the taxation of dividends is very noticeable indeed.

The taxation of American dividends is different from the Czech ones. Here, the basic rate is 30 % (which may seem very high to clients), but if the client fills in the W-8BEN form, they will reduce their rate by half to an interesting 15 %. Finding the form is not difficult at all. It is available on the company’s website at www.degiro.com under the Profile Page- Tax Informant tab. It is very quick, easy and client friendly.

Dividend payments in shares can be used for selected stock titles, but this is subject to a one-off fee of €7.50.

DeGiro fees

Here indeed “hats off” to DeGiro. No brokerage company I know has a “FEES” tab as the first tab, and certainly not one have it this clear, simple and most importantly, EASY!

In this tab you will find 3 sections namely directly “fees”, “save on most popular ETFs” and also the option to “open an account”. We will get to everything in this section.

Overview of fees

DeGiro is really very pro-client. As it states on its website in the fees section, it tries to make investing accessible to everyone.

Fees for trading stocks and ETFs

The fees are very clear and simple. Let’s describe and explain them now.

Trade Brokerage Fee (Commission) – A commission is a one-time fee that an investor must pay for each purchase or sale made. The amount of this fee depends on what product you are trading and on which exchange the trade is taking place at that particular time.

Handling fee – Along with the commission fee, the investor also pays a fixed fee of 50 cents (10 CZK) for each trade, which Degiro uses to cover external costs. This fee need not be paid only for futures, options, and free ETFs.

The difference between the bid and ask price (spread) – here the company states that spreads are market-based. Which means that the broker does not charge any fee.

Currency conversion fee – It is of course possible and very common that a situation arises where the currency of your account and the currency of the instrument you want to trade is different. In this case, a currency conversion fee is charged. The amount of the fee is 0.25% (automatic transfer) or 0.25% + 10 € (manual transfer). Transfers between CZK and EUR are free of charge. Which is good news for Czech clients who, according to statistics, trade with EUR very often.

Other fees

Other fees will be a very quick and easy topic. Again, good news for investors. This is because there is no deposit fee, no withdrawal fee and there is even no inactivity fee as is common with other brokers in the market. So, an investor can take a “break” in their investing whenever they like. This is also very often due to the fact that the client needs to withdraw their funds for a period of time and use them elsewhere.

However, I would like to mention the fee for trading on a foreign exchange. This is EUR 2.50 per year. Foreign Exchange Trading Fee – You pay €2.50 per year for each exchange you enter with an interest in trading. Only the Prague BCPP does not pay this fee.

Additional services – Of course, like anyone, this broker may charge a fee for live data from the exchange, for portfolio transfers to/from DEGIRO, for shorting stocks and so on. A clear list of all these fees can of course be found on the website.

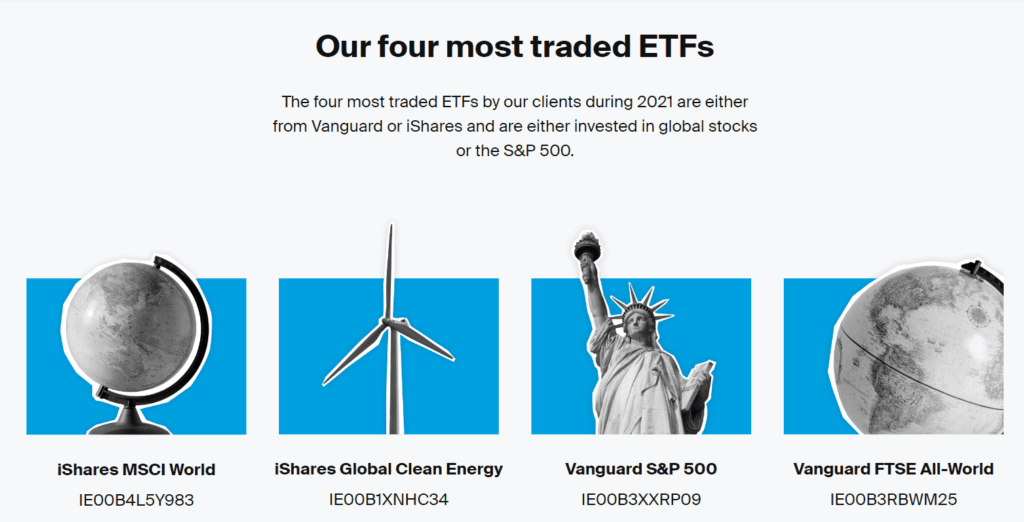

Save on the most popular ETFs

The name of this section in the fees tab is already a big attraction and I have to say a very pleasant surprise for me. Just the beginning, when DeGIRO talks about diversification, which is a very essential part of trading financial markets, as well as the opportunity to browse the main selection. This means that each client can “click” exactly where they want to trade, what they want to trade, what exchange they are interested in. Once this selection has been made, the investor is then given a ranking of all the products they offer according to their choice.

What’s really great, though, is that the client can also choose the level of expense they are willing to pay. The expense ratios for each product are very clearly listed.

I tried this option myself and was really impressed. Not only is everything very detailed in one place, but I can see the essential values such as the benchmark index, the ESG rating and the aforementioned total cost index for the deal. See the table below.

DeGiro trading platform and website

Trading with this company can take place via the Degiro web platform or mobile app. What I especially appreciate about the platform is that despite the number of features and trading options it offers, it is still very intuitive, simple and client-friendly. The simple design of the app feels professional and does not distract the client from their finances and trades.

In this platform, or also of course in the app, you place so-called orders. With this order, the broker will buy the product you require. So, what types of orders can you use with this company?

- Limit – with limit orders, the client sets not only the volume, but also the price at which he wants to buy or sell the instrument. As soon as the price on the stock exchange reaches this desired value, the order is executed. It should be noted that a limit order may not be executed completely (i.e., the client may not receive the number of shares he ordered, or the trade may not happen at all – the reason for this is often the unrealistic price requested by the client)

- Market – This is practically a classic trade. You only choose the volume (for example, the number of shares) you want to buy. This trade is executed immediately and at the best price available on the market at that moment. For less liquid instruments, you have to take into account that the order may settle at a worse price than what you currently see on the chart.

- Stoploss – Such an order from the client is used to automatically close a position (e.g., sell the purchased shares). The investor sets here the price at which he wants to close the investment, i.e. sell (stop price). As soon as the stock price crosses the set level, the Stoploss triggers a market order to sell.

- Stop-Limit – This is a very interesting option offered by the company. It is a combination of Stoploss and limit order. So, the client has to fill the stop price and the limit price. Once the market crosses the set stop price, a stoploss order is created. However, the sale does not happen immediately, but only after the set limit price is reached. For many traders this is a very interesting option to trade.

All the information you need to know about trading with DeGiro can be found in the trading tab. You can find information about the platform and the app (which we have already discussed), but also check what broker awards the broker has won. It’s certainly worth mentioning here that DeGIRO was named “Best Stock Broker for Stock Trading in 2022” This award won in the UK is certainly not the company’s first achievement. You can see for yourself.

DeGiro website

After opening the company’s website, I was a little disappointed. I found it very crude, devoid of ideas, and lacking in flair. But after the first few steps on www.degiro.com, I understood the reasons. The company obviously knows the old motto “simplicity is beauty”. Not only that, you can easily find everything you need as a client, or a prospect, or even just an inquisitive reader. But there’s really nothing to distract you from the goal you’re after. Finance!!! The company is very aware of its strengths and its website really knows how to sell them. Simple bookmarks that guide the client where they need to go.

Education

Investment education should be a priority for clients, but also for brokers. Because it is not very often that someone who knows absolutely nothing about this area is successful. But that doesn’t mean that these people can’t invest. This is exactly what DeGiro offers. Again, I was very excited after opening the “knowledge” tab.

The “knowledge” tab is divided into 3 sections, and they all seem to be very useful to the end customer. That is, the investor.

- Investment Academy

- Investing with DeGIRO

- Documents

Let’s take a look at each section and briefly review what they contain and what they bring to investors.

Investment Academy – a very apt and punchy name. The company refers to this section as a hub for investment knowledge. Thanks to these lessons in finance, even a total slob can start investing immediately. Clients that have awareness can supplement their knowledge here. Here we find 10 sections with clear themes. In each section it is possible to start a video. But if you are more of a reader type, everything is beautifully described in text form as well.

- What type of investor are you?

- What is a broker?

- Basic financial products

- Complex financial products

- What determines the price of a stock?

- Choosing your first stock

- Types of orders

- Spreading risk is key

- Thinking ahead

- What is your plan?

Investing with DeGIRO

If the client is educated in the field of investments, they can seamlessly move on to the next tab, which is “Investing with DeGIRO. Here, as in the previous section, he will find videos that directly show how to trade with this particular broker. Specifically, how the client can make deposits and withdrawals, how to buy a share or possibly a bond. The videos are simple, intuitive and will certainly help the client a lot in the beginning.

The next and final section under the “knowledge” tab is documents. Here the title is a bit misleading. I was actually looking for some documents, physical papers, to use for financing. Which I thought was strange given the company’s online approach. By documents, I don’t mean forms and similar outdated physical papers, but film documents that present clients with true stories of investors and situations that can happen in the financial market, so the client should really be prepared for that. Below these episodes can be found a broker’s note which I would like to quote here. It is very relevant.

“Investing involves the risk of loss. This film is for informational and entertainment purposes only and is not a substitute for investment advice or individual research and investigation. This film should not be construed as an invitation, offer or invitation to engage in any investment activity. FlatexDEGIRO does not endorse any third party statements made in these films.”

Registration

Registering on the www.degiro.com website is very easy, we’ve talked about this before. However, what may bother potential clients is the lack of a demo account. Some brokers offer this so that clients can try out their services. Whether for 30 days or longer. But the client has this option. DeGIRO companies do not offer this option. On the other hand, they can afford it. Other brokers don’t have such low fees. However, what is another important thing that overshadows the lack of a demo account is the fact that the investment option is really with small amounts. So if the client just wants to try investing, here he does not have to worry about losing a large amount of his funds.

Almost every part of the website encourages people to open an account. But what if the client hesitates, makes a mistake during registration, or needs some questions answered? Here you need to go to the “help” tab. You will immediately be redirected from the Czech website to the English one. Here you can enter your query or find the answer to your questions.

Registration is therefore only done by entering an active e-mail address, username and password. It is necessary that the password meets several security features and is entered twice for checking. By opening an account with DeGiro, you also agree to the company’s terms and conditions and are informed about the privacy and cookies used by the site.

Investors who want to actually trade as conveniently and online as possible can use the mobile app. Download information can be found below the registration form. It works of course with the app store and google play.

Very unobtrusive information (but very essential) is hidden on this registration page in the bottom left corner. It concerns when we can contact the company and when they will reply. So, if you have any problems, you can contract the company via email: klienti@degiro.cz and this is Monday to Friday from 8:00 to 22:00. Not every brokerage company offers this option. So, I rate it very positively.

Our rating of the broker DeGiro

Advantages

- Very low fees

- Deposits and withdrawals completely free

- Clear and simple company website

- Everything in one place

- Easy to open an account with a broker

- Education and explanation of concepts at a very high level

- Client security first and foremost

- Very chic product offering

- Free trading of US stocks and selected ETFs

- Czech language support

- Option to trade in Czech crowns

- Global awards

Disadvantages

- Payments can only be made by bank transfer

- High dividend taxation on Czech shares (we are talking about 35% tax)

- DeGiRo does not support fractional shares

- There is no demo account option for potential clients

We always try to be as open as possible with our readers. It is, after all, about your FINANCE. However, if you are a small or medium investor, I dare say that DeGiro broker is indeed the right one for you. From the initial education, to choosing the right investment instrument, the company will guide you to your ultimate goal, which is to trade on investment markets around the world.

After seeing the pros and cons of trading with DeGiro and navigating their website, it is evident that there are really many, many more positives. In some parts, I was expressly impressed with all that a broker can do and how they can communicate this information to their clients.

So, if after reading this review you are impressed with the company, visit www.degiro.cz and you can start trading immediately and easily. Fingers crossed.