CMCMarkets.com is a CFD broker that offers to trade CFDs on forex pairs, stocks, indices, commodities and cryptocurrencies. This company is licensed in Europe by the UK regulatory authority FCA and the German authority BaFin. The minimum deposit at CMC Markets broker is set at $0, so you can start trading on a real account with any amount.

CMC Markets Review – broker overview

| Minimum deposit | 0 USD |

| Regulated broker | Yes |

| Regulation | FCA, BaFin |

| Trading platform | MT4, their own |

| Demo account | Yes |

Special features and advantages

| Price alerts | Guaranteed stop-loss | Trailing stop-loss | Publicly traded company (shares) |

Trading platforms

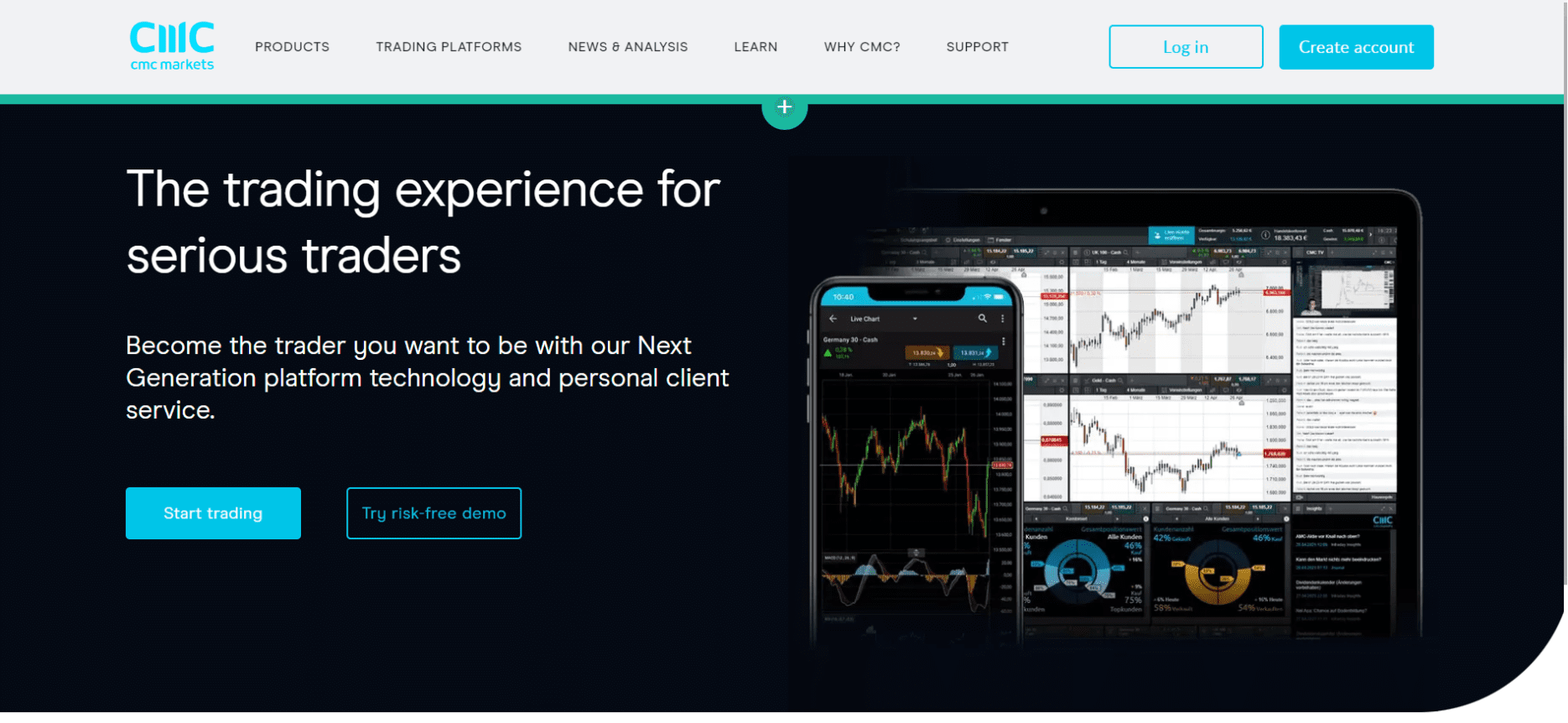

CMC Markets offers its clients a total of 2 trading platforms – MT4 and Next Generation. The MT4 platform is very well known among traders and so needs little introduction. One can use automated trading systems (EAs) on it and it offers a handy environment for technical analysis. Next Generation is a platform from broker CMC Markets and according to the company’s website, this platform provides a handy solution for market analysis (there are over 115 indicators and drawing tools).

CMC Markets fees (spreads)

Just like any other CFD broker, CMC Markets charges a spread fee. For the current value of this fee, please visit the CMC Markets website. We have prepared a small comparison table here, where you can find the amount of CMC Markets spread fees on popular currency pairs compared to 2 other popular CFD brokers.

| EUR/USD | USD/JPY | GBP/USD | AUD/USD | |

| Plus500* | 0.6 | 0.7 | 1.1 | 0.6 |

| XTB* | 0.8 | 1.4 | 2.0 | 1.7 |

| CMC Markets** | 0.7 | 0.7 | 1.1 | 0.6 |

**minimal spreads. The data was gathered from broker’s website 19/12/2019 at 21:10 GMT

Broker review summary

CMC Markets must comply with strict regulatory guidelines from the FCA and BaFin. The broker offers a total of 2 trading platforms and a limited time free demo account. The range of assets here is very diverse, with CFDs on approximately 3,000 stock titles and 300 forex pairs. The spreads that the broker charges are solid and comparable to the competition. Keep in mind, however, that when trading CFDs on shares, you are also subject to a commission fee (which starts at 0.10%). There is no minimum deposit with the broker, so you can trade with any amount. Nevertheless, the broker recommends a deposit of at least $250.

Advantages

- Free demo account

- A lot of assets to choose from

- No minimum deposit

- Relatively good spread values

- Strict regulation

Disadvantages

- Demo account for a limited time period only

- Commission fee for CFDs on shares