XTB is one of the leading international forex brokerage companies in the field of online trading. It is unique in that it has 5 financial regulators and keeps users’ funds in separate accounts. The company believes it has the most favorable trading conditions, let’s take a look at it together in our review, in which you will get the opinion of practicing traders.

Table of Content

- XTB – About Us, Security & Regulation

- Basic information about XTB

- XTB Broker Regulation

- History of XTB

- Trading instruments – what can I trade with XTB?

- Comparison of XTB with competitors

- Registration process

- Types of accounts

- XTB Trading Platform

- MetaTrader4

- xStation

- xStation mobile trading platform

- XTB broker website interface

- Accepted XTB countries

- XTB Affiliate Program

- Education

- Overview of fees

- Comparison of XTB with other brokers

- Conclusion of XTB review

- XTB Final Evaluation

- Site additions

- General information and contact details

- Media

XTB – About Us, Security & Regulation

The world first became aware of the forex broker XTB in 2002, its brand abbreviation stands for X-Trade Brokers. The company is registered and based in Belize. Brokerage services are provided through the official web portal www.xtb.com.

Basic information about XTB

| Account currency: | USD |

| Minimum deposit: | 1 USD |

| Leverage: | Up to 1:500 |

| Spread: | From 0.1 pip |

| Instruments: | Currencies, stocks, indices, commodities, cryptocurrencies, CFDs |

Basic information about XTB broker

XTB Broker Regulation

A key feature is the availability of certificates from five regulatory bodies, including the FCA, IFSC, CNMV, CMB and KNF. Certain criteria and requirements must be met in order for such a licence to be issued, and breach of these or any fraud will result in the immediate loss of the licence. Another positive fact necessary for a good provider is the security of client funds. XTB keeps client money separate from corporate funds in Europe. Speculation with client funds is completely excluded here. There is also a deposit guarantee of up to €20,000. XTB therefore gives us a very serious and trustworthy impression. Fraud on customers can definitely be ruled out. Trading takes place via the STP NDD system, which certifies access to interbank transactions.

Another positive fact necessary for a good provider is the security of the client’s funds. XTB keeps client money separate from corporate funds in Europe. Speculation with client funds is completely excluded here.

History of XTB

It is known that the company has undergone several rebrandings in its 20 years of existence, during which it has changed its name and founder. Currently, it helps traders trade in the interbank foreign exchange market around the world. To this end, the company has opened subsidiaries in Spain, Poland, Germany, France, the UK and other countries. According to its Wikipedia page, XTB has a total of more than 250,000 users. The company’s activities are believed to be aimed exclusively at European investors. XTB has won a number of major awards, including Best Broker in Europe by Global Banking & Finance Review and Best Financial Teacher by World Finance Exchange Brokers.

Don’t overlook: bitmarkets.com reviews

Trading instruments – what can I trade with XTB?

The broker offers the opportunity to trade currency pairs, commodities, stocks, indices, bonds, CFDs and cryptocurrencies. As well as CFDs, you will also be able to trade Bitcoin and many other cryptocurrencies with XTB. There are over 30 cryptocurrencies available including the aforementioned Bitcoin, Ethereum, Litecoin, Ripple and more along with a total of 50 cryptoassets. The spread for these assets is variable, but if we take Bitcoin as an example, it is usually between 0.22-0.33% of the market price, with other cryptocurrencies reaching up to 2%. So overall, if you are interested in trading cryptocurrencies as a CFD, then XTB could be a good option for you.

The broker offers different levels of access to educational and research materials depending on deposit size and trading volume. VIP provides full access to all materials, a traders club and the option to use a personal manager. Standard, PRO and Islamic accounts with market execution are available to choose from. XTB offers protection against negative balances on all account types, preventing you from losing more than your initial investment. The maximum leverage is 1:200. Spreads start at 0.28 pips and can vary significantly depending on market conditions. The commission for 1 lot is $4. Active traders can expect to receive a refund on their trades.

Each type of instrument has its own specific terms and conditions. If you open the “Market Analysis” section on the XTB website, you will find special price tables there. For each instrument, you can enter the current price including bid, ask, spread and percentage change values. Click on the “Instrument Characteristics” button below each table to see information on all instruments in that category, as only 10-15 instruments of each type are displayed on this home page.

Comparison of XTB with competitors

| DeGiro | XTB | eToro | BitMarkets | |

| Shares | Yes | Yes | Yes | – |

| ETF | Yes | Yes | Yes | – |

| Bonds | Yes | – | – | – |

| Futures and options | Yes | – | – | – |

| Cryptocurrencies | – | – | Yes | Yes |

| CFD | – | Yes | Yes | – |

| [Review] | [Review] | [Review] | [Review] |

Comparison with competitors

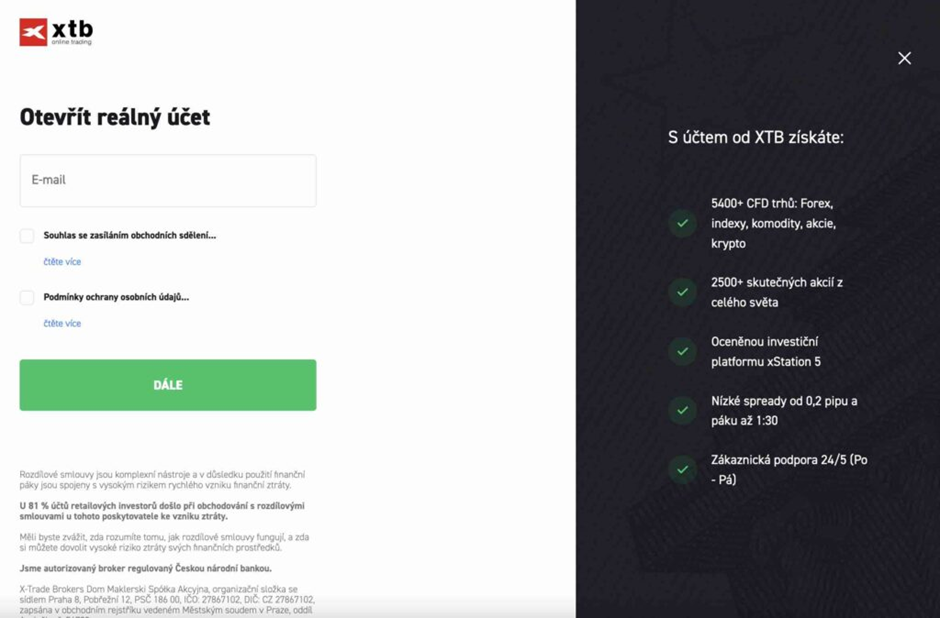

Registration process

Traders can trade on the X-Trade Brokers market on a demo account or on a live account. However, before you start trading, you need to create a client profile. For this purpose, you need to:

- Go to the broker’s website and select the “Create Account” button.

- Enter your email address, check your user agreement and click the “Next Step” button.

- Make up a password and enter it in the box that appears.

- In the new window, fill in the form with your personal data: name, surname, phone number, country of residence, date of birth.

- Once confirmed, another form will appear asking you to enter your full address and postcode.

- Then choose your trading platform and account currency.

It is important to note that registration will take a long time. In addition, the user must submit a declaration of income and other financial data showing the sources of material resources. Starting trading in a private office will be available after verification of the trader’s details.

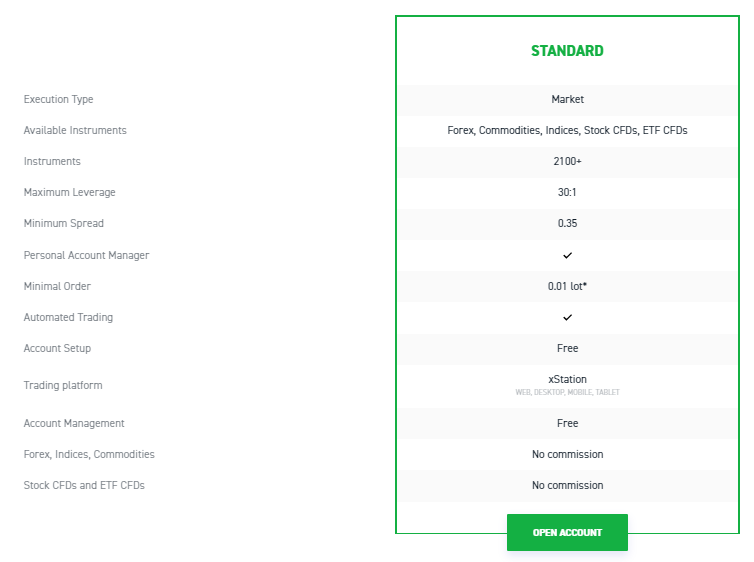

Types of accounts

There are 3 types of trading accounts:

XTB Standard Account

One of the most popular XTB account types for many traders is the XTB Standard account. Here you will be pleased to know that in most cases there is no minimum deposit at all, although this depends on the country you are trading from.

However, some countries offer 3 types of XTB Standard accounts with different minimum deposits of $1, $1,500 or $15,000 depending on the account type. The higher the level of your account, the lower the spreads.

If we focus on a typical standard XTB account that you will find at most places, the spreads will be very competitive, starting with a variable spread of 0.3 pips and with over 5,200 assets tradable as CFDS. We believe that with so many options, anyone can choose, even the user looking for the most affordable options.

XTB Professional Account

The XTB Professional Account is available to EU and UK traders who are regulated by CySEC, provided they meet certain conditions. To qualify for this type of account, you should meet at least two of the following conditions:

In the past year, you have executed an average of 10 transactions of significant size per quarter.

Have a portfolio of financial instruments worth more than EUR 500 000 (in a bank or trading account).

Have relevant experience in the financial services sector

If you meet these criteria, you will be eligible for a professional account. Through this account you will have access to more leverage, up to 200:1, when trading forex. Unlike some brokers, you will also retain negative balance protection with XTB in this account.

You’ll have access to forex, index, commodities, equities, ETFs and cryptocurrency markets, and trading will be made available through XTB’s proprietary platform, XTB xStation.

XTB Islamic Account

XTB Islamic trading is also available if required. You can access it through your XTB Islamic account. This type of account does not charge any day trading fees and is therefore fully Sharia compliant.

However, this type of account charges a slightly higher fee of USD 10 per lot traded.

You can always access further information through our article on the best swap-free forex brokers, with XTB being a popular choice among Islamic traders here.

Demo account

A demo account with any broker is an excellent place to start, and XTB’s demo account is no exception. With a demo account, you can trade virtual funds completely risk-free, but in an environment that closely replicates real trading and gain invaluable experience.

Moreover, even if you open a demo account, you are not obliged to open a real trading account at any time. For beginners, then, it is ideal for getting acquainted with the broker.

Clients can open a free demo account for 4 weeks to evaluate XTB’s services and learn how to trade FOREX without risk. The demo account allows them to work with 100,000 virtual dollars. The registration process is much simpler; you only need an email address and country of residence. The next step is to follow the link you receive in the mail and you can start trading.

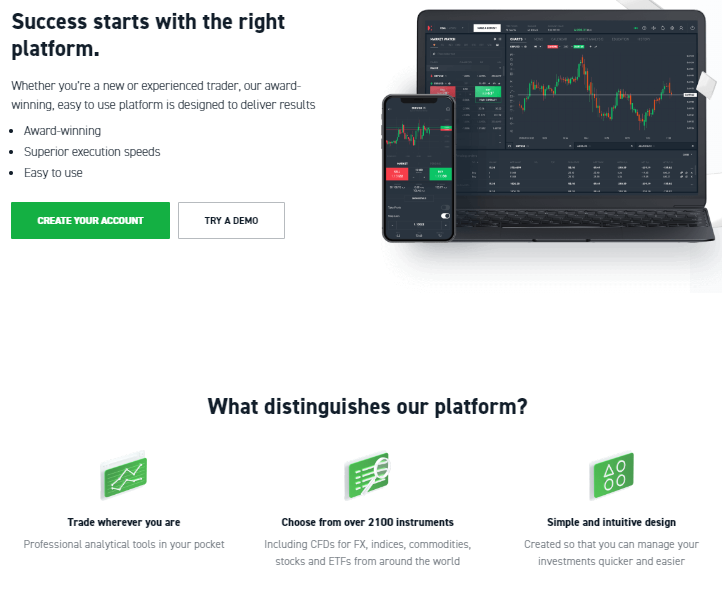

XTB Trading Platform

The broker uses two trading terminals for online trading:

MetaTrader4

MetaTrader 4. It is a classic software with a wide range of features and a huge selection of tools for effective technical analysis. Expert advisors and automated trading robots are available when you register a Pro account. You can download the XTB app or also trade with XTB via the MetaTrader 4 app in the Apple App Store.

Download Metaquotes MetaTrader 4 for free from the Apple App Store. XTB customers have instant access to these financial markets with complete portfolio management on the go.

xStation

xStation. Innovative software developed in-house with an easy-to-use interface and a large number of popular indicators and market prediction tools. Compared to other platforms, xStation 5 really deserves a mention because not every forex broker offers a good and reliable trading platform. Thanks to various tests and traders’ ideas, xStation has proven to be very powerful and you can access the markets in real time.

xStation mobile trading platform

XTB’s xStation trading platform is also accessible via mobile devices. You can easily install it on your Android or iOS device and start trading from anywhere.

The mobile trading platform has a responsive design so it can be easily used on any type of devide. The xStation mobile platform offers most of the features that xStation 5 has, but not all. In total, you have 30 drawing tools and 39 technical indicators, which should be enough to make trades on the go.

In addition to these, the XTB mobile platform also gives you access to the news section and other important market analysis tools that the broker offers to its members for free.

XTB broker website interface

Every broker must focus on user experience. A smooth and uncluttered user experience can mean the difference between a successful platform and one that struggles to get off the ground.

XTB.com offers investors an excellent user experience that makes using the platform a dream. As one heads to the XTB homepage, they are greeted by a sleek, predominantly black and white color scheme that highlights key areas of the platform.

Important sections, such as XTB’s various financial instruments, are clearly marked and highlighted in green, making navigating the platform incredibly intuitive. In addition, XTB makes sure that key information is easily accessible and not hidden behind unnecessary menus.

All these factors go hand in hand to create an excellent user experience. Even investors who have never used a broker before can easily get used to the platform. It is one of the best designed brokers, which makes it a pleasure to use.

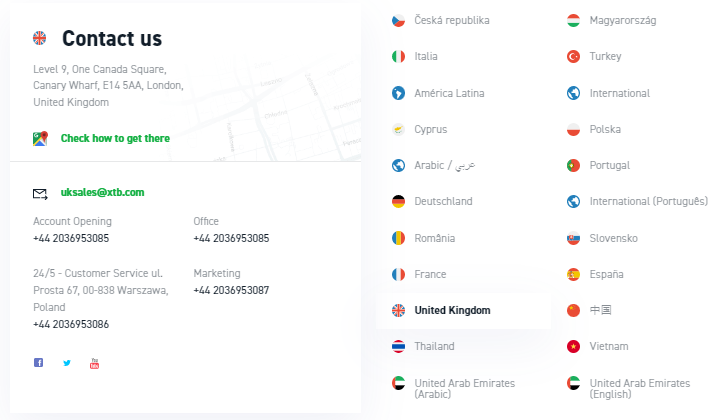

Accepted XTB countries

XTB is available in a number of countries around the world. It operates in most major countries where trading is popular, but we were surprised by a few notable attractions. There are a few geographically specific restrictions, for example UK residents cannot trade cryptocurrencies on XTB. In addition, the broker currently does not accept clients from the United States, India, Australia, Belgium, as well as a few other countries mostly in the Asian or African region.

XTB Affiliate Program

“XTB Affiliate Program” – the client can earn additional income by promoting the broker and acquiring new clients. The amount of this income is up to 20% of the recommended client’s margin.

“XTB Cashback Rebates” – is aimed primarily at active merchants. The client has the opportunity to receive a partial spread compensation depending on the performance of the monthly trading volume.

As we can see, the broker offers fairly loyal affiliate programs that allow you to earn a portion of the commission from the broker and build your own referral network. And for active traders there is an opportunity to convert a certain number of trading lots into a partial rebate.

Education

Clients of the XTB Dealing Center can use the relevant section to gain new insights into the forex market and forecasts of the current situation. It contains the following materials:

- current values;

- NEWS SOURCE;

- schedule of business sessions;

- economic calendar;

- forecasts for the selected trading instrument and country;

- Business reviews conducted by the Centre’s analysts.

As for the training centre, it is divided into three categories:

Knowledge base. It covers the basics of trading in the interbank foreign exchange market and the rules of executing transactions with a step-by-step explanation of opening and closing orders.

Live webinars. They are held according to a set schedule and are led by the company’s leading speakers.

Business Academy. It offers basic and professional courses for traders with a certain level of knowledge. Lessons are free and you can learn useful information through an automatic translator.

The training materials are available to all traders who have a real trading account and their personal details are successfully verified. However, it should be noted that all materials are in English only.

Overview of fees

Deposit on account

To deposit money into your XTB account and start trading, simply log in and go to the “Deposits” section. There you simply select your trading account and payment method. XTB offers different deposit methods. These include bank transfer, VISA, MasterCard, PayPal, PaySafe Card and Skrill. XTB deposits are generally free of charge. The only exception may be some e-wallets. These may charge 1.5% to 2% depending on your location. You may also be charged a small conversion fee if the currency of your deposit does not match the available base currency of your account. Please note that if you deposit money into your XTB account in a currency other than your bank’s currency, XTB will not charge you conversion fees. Each region also has some special conditions for depositing funds. Check this when you open your account.

Wire transfers are free and accepted in US dollars. In some cases, your bank may charge a transfer fee, but XTB will not charge you any additional fees. Wire transfers to your XTB account must come from the banks where you are registered. Your bank account name must match the name of your XTB account. If this is not the case, you risk wasting your time as the funds will be returned to your original bank account.

Collection of funds

Withdrawing money from your account is also easy. Open your personal locker and select the account you want to withdraw from. Then select the amount you want to withdraw. Remember that if the bank account you want to withdraw to does not match the currency of your trading account, the broker will convert the amount at its own exchange rate, either at the time the bank receives the payment or at the time you request it. As with deposits, you can only withdraw to a bank account that has the same name as your brokerage account. For withdrawals, XTB processes payments according to the SHA model and pays the full cost charged by the sending bank. Your bank may charge you an additional fee. If you choose to withdraw less than $100, you will be charged an additional $30 fee.

Business fees

As for spreads, you will find that XTB only offers them as floating spreads.

For XTB Standard accounts, the spread usually starts at 0.3 pip in most countries, although this is not always the case.

In countries where three types of standard accounts are available, spreads start at 0.7 pip in a Standard A account, 1.5 pip in a Standard B account and 2.8 pip in a Standard C account.

Trading on XTB is often fee-free, although a fee of $5 per lot traded applies when trading on an Islamic account that is swap-free.

A commission of 0.08% is also generally applied when trading CFD assets through a broker.

There are also no fees for real stocks and ETFs at a monthly volume of €100,000, which are only available to EU traders.

Non-trading fees

When trading with XTB, you may encounter a few additional fees from time to time.

Overnight fees

The overnight fee is the fee you must pay if you hold a position after the market closes. As XTB is a CFD broker, this fee applies to almost every asset held overnight.

As the fee changes every day depending on the market, you can get up-to-date information on the exact amount of the fee through your trading platform on any given day.

The only type of account that does not apply an overnight fee is the XTB Islamic account.

Fees for inactivity

XTB charges an inactivity fee. This XTB inactivity fee is only charged if you are inactive for 1 year. In this case, the broker will charge a monthly fee of $10 until you log back into your account.

We also reserve the right to close your account if you do not have a sufficient balance to cover the fees.

This inactivity fee only applies to real trading accounts, not to XTB demo accounts.

Risk Management

Risk management plays a big role in the success of any trader. This is no different when trading with XTB. To this end, the broker makes available a number of tools through the trading platform that you can use to manage risk.

These include the ability to set stop losses, take profits and trailing stops to manage your positions. You can also place limit orders when you enter the markets.

Last but not least, the broker also provides margin calls to stop your capital falling below a certain amount if you are trading on leverage.

Technical support

If you have any questions about working on the forex market or operating the trading terminals provided, you can contact technical support for advice. For this purpose, the following contacts are available on the website:

- Helpline: +44 203-695-30-86 (for UK residents);

- E-mail: uksales@xtb.com;

- ticket system (feedback form);

- online chat (in the right corner of the website).

Technical support is available 24 hours a day, Monday to Friday. However, as stated in the feedback, merchants do not get answers to questions immediately.

Comparison of XTB with other brokers

| XTB | AMarkets | Admiral Markets | |

| Trading platform | MT4, xStation 5 | MT4, MobileTrading | MT4, MT5, iPhone, iPad, Android, MT4 Supreme Edition |

| Min. deposit | $1 | $100 | $100 |

| Lever effect | from 1:1 to 1:500 | from 1:1 to 1:3000 | from 1:25 to 1:500 |

| Demo account | Yes | Yes | Yes |

Comparison with other brokers

Conclusion of XTB review

XTB Online Trading is a very good forex trading platform (some even say it’s one of the best forex brokers) and offers a particularly friendly trading platform for newcomers.

In addition, you can also trade CFDs on cryptocurrencies, stocks and commodities. If you’re not necessarily looking for a specialist forex broker, you’ll appreciate the variety of markets they offer access to.

And when it comes to pricing, their spreads are very competitive in the forex broker industry. Plus, you won’t be charged any deposit/withdrawal fees, which is good if your goal is to add funds to your account on a regular basis.

Overall, XTB Online Trading is an established, low-cost and trustworthy forex broker (thanks in part to its Financial Conduct Authority certification). You really can’t go wrong here, no matter what markets you want to trade.

Advantages

- availability of two convenient platforms;

- the availability of an Islamic, untrustworthy account;

- minimum deposit of USD 1;

- quite a wide range of trading instruments;

- availability of the mobile platform;

- several ways to deposit and withdraw money.

Despite the long list of strengths of the broker, a number of drawbacks should not be overlooked:

Disadvantages

- The demo account is only available for 30 days;

- lengthy and complicated registration procedure;

- there are no PAMM accounts

XTB Final Evaluation

Site additions

General information and contact details

XTB Group operates in a number of countries around the world. The Prague office is located in Florence, and can be contacted via a toll-free phone line or email. Live chat is also available on the website. The website cannot be recommended for beginners due to its detail, but it can be a very good choice for experienced investors.

Media

- Facebook: https://facebook.com/xtbczsk

- Twitter: https://twitter.com/xtbczsk

- Youtube: https://youtube.com/xtbczsk

- Web: https://www.xtb.com/cz

Read also: review of competing broker Wonderinterest